Oh, from 88 fifty-eight information returns for us persons with respect to foreign disregarded entities, and you will see that that term is referred to as fed and the other term which we just discussed you're going to see here under what's new is ABU qualified business unit so two things I want to focus on the form one what is new skills of M is updated it's been around for a couple of years but you want to go over the special items let's go, so I am the other thing is the QBE qualified business unit we saw from that previous website that this is a major concept, and it's something that the client needs to be aware of. Category one Fowler's I mean this is so interesting to me because really if you own all the entity just ask report everything, so I just kind of get going to guide you through what forms you need, we're pointing for and reporting the exchange rates on Form eight five eight form eight five eight really seems to especially the'll see to be focused on this qualified business unit currency gains and losses, so your client then be shocked when you show them how much work is involved, and we're going to go over some major aspects of this in just a second here on the instructions. Functional currency is always a big item and some tax planning opportunities in some cases unfortunately you have to really get to know these code sections and these regulations' hyperinflation exception you know so far the few nations have that have hyperinflation some have just given up their current seeing on to the U.S. dollar, but I want to get down to Schedule C here because it is beginning of this qualified business unit...

PDF editing your way

Complete or edit your form 8858 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 8858 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 8858 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 8858 instructions by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 8858

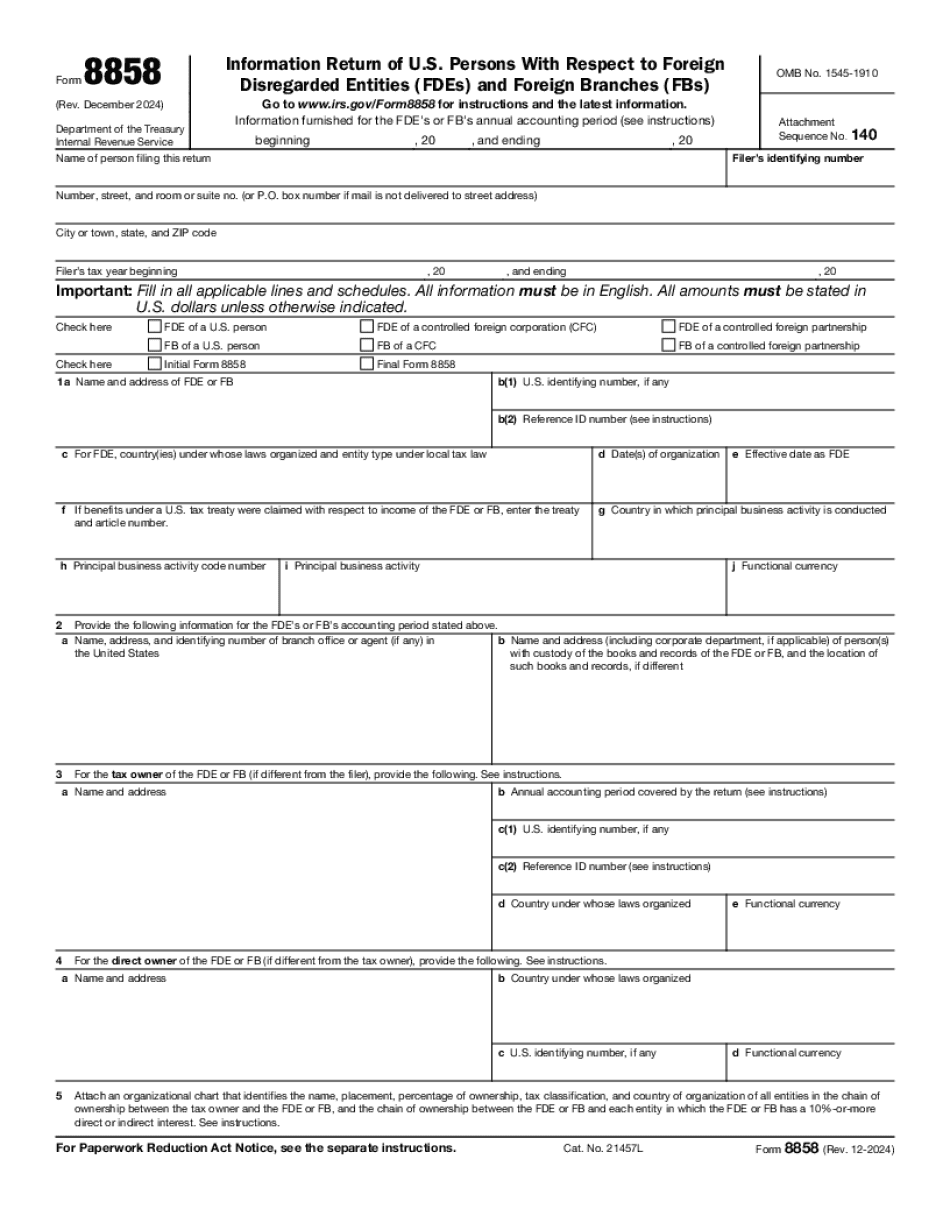

About Form 8858

Form 8858 is a tax form used by US taxpayers who have a foreign disregarded entity (FDE) or foreign branch. It is used to report information about the foreign entity to the Internal Revenue Service (IRS) and to disclose any transactions or dealings with the entity. An FDE is a type of foreign entity that is not recognized for US tax purposes, meaning that its income and expenses are not reported separately from the taxpayer's personal tax return. A foreign branch is a business unit located outside of the United States that is part of a US person's trade or business. US taxpayers who own 100% of an FDE or foreign branch must file Form 8858 with their annual tax return. The form provides information about the entity's organizational structure, ownership, financial statements, and other details required by the IRS. Failure to file Form 8858 can result in significant penalties and could also lead to tax audits and investigations by the IRS.

What Is 8858?

Online technologies make it easier to arrange your document administration and raise the efficiency of your workflow. Look through the short tutorial in an effort to complete Irs 8858, stay clear of errors and furnish it in a timely way:

How to complete a Form 8858?

-

On the website hosting the document, click Start Now and pass for the editor.

-

Use the clues to fill out the relevant fields.

-

Include your individual data and contact details.

-

Make sure that you enter right details and numbers in appropriate fields.

-

Carefully examine the content in the document so as grammar and spelling.

-

Refer to Help section if you have any issues or address our Support staff.

-

Put an electronic signature on your 8858 printable using the support of Sign Tool.

-

Once blank is done, press Done.

-

Distribute the prepared via email or fax, print it out or save on your device.

PDF editor makes it possible for you to make adjustments on your 8858 Fill Online from any internet linked gadget, customize it in line with your needs, sign it electronically and distribute in different ways.

What people say about us

How you can fill in templates without mistakes

Video instructions and help with filling out and completing Form 8858